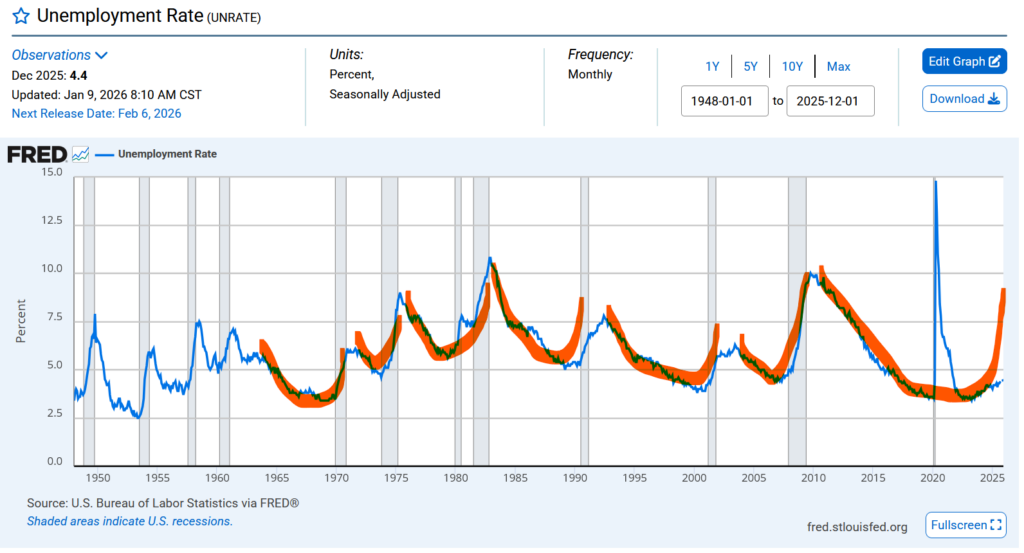

Last year I predicted there would be a significant (2008+) economic crash that year. The year is now 2026 and I was wrong. At the time my main argument was essentially this:

The unemployment rate just follows these smooth curves, covid was an exception, and it was due to jump again. Not very scientific I know. There was another important graph of course:

Where classically an inverted yield curve has been a recession predictor. This one is a little more involved, but essentially the US government borrows money and normally what makes sense is that the government needs to pay more money every year in interest if it wants to borrow the money for longer. If, for some reason, the market says “no actually we will take a lower fee if you take our money for longer” that is an inverted yield curve, and here that is shown by the difference between the interest on a 10 year loan and a 2 year loan being negative. Why this would predict market crashes is a complex topic and I encourage you to read around about it. It isn’t perfect of course, and one “feature” is that it isn’t “wrong” yet, at least unless we don’t get a crash within the next few years.

But come on.

It surely will be this year.

Here’s the current price of silver. Gold looks kinda similar (but smoother, I chose silver because it looks dramatic, but maybe it got you to read this further so that’s a win in my book). People buy precious metals when they might be worried about the value of fiat currencies, like, I don’t know, the dollar. Are people worried about the dollar?

To be honest I’m glad we are the ones getting out of that market first. Why might people be worried about the dollar?

Eh, I don’t know, there are lots of possible reasons and maybe you can think of some. The actual point is this:

- US government debt has been a worry for a while. That worry doesn’t matter so long as people have faith in it, but it does matter insofar as it makes a possible debt crisis deeper. The bigger they are, the harder they fall.

- There are one or more bubbles in the stock market. Almost everyone agrees that AI is a bubble. It funds itself in a circular fashion, and capex cannot be recovered with profits any time soon, even with optimistic outlooks. Other stocks may also be well overvalued, with sky high PEs and nonsensical business models (meme stocks are just the worst offenders)

It feels as though all we need is a spark. And yet, many sparks seem to have come and gone. Big market moves, in stocks or yields, that have recovered. Tariff and invasion threats, protests, you name it, they might move the needle but it always seems to move back. So, perhaps we won? Perhaps we built our markets so stable that they are these days impervious? That sounds silly on its face, and the two reasons I’d actually give are:

- Markets are just slower moving than ever before, big players just like to sit on their big piles of money, and it’s much easier to just assume the needle will go back and then everyone pats you on the back when it does. No client likes a skittish fund manager that ends up always being wrong

- This is the 11th time that tariffs have happened, and it just isn’t surprising anymore.

Which is to say that no individual decision make want’s to be the first mover, so the market does not move.

A year ago there were a few signs. Right now, it feels like everything is primed to blow. Is that new? Do I always just feel that way? Am I just a broken clock that’s going to be right today? Maybe, but I damn well intend to be right at some point.